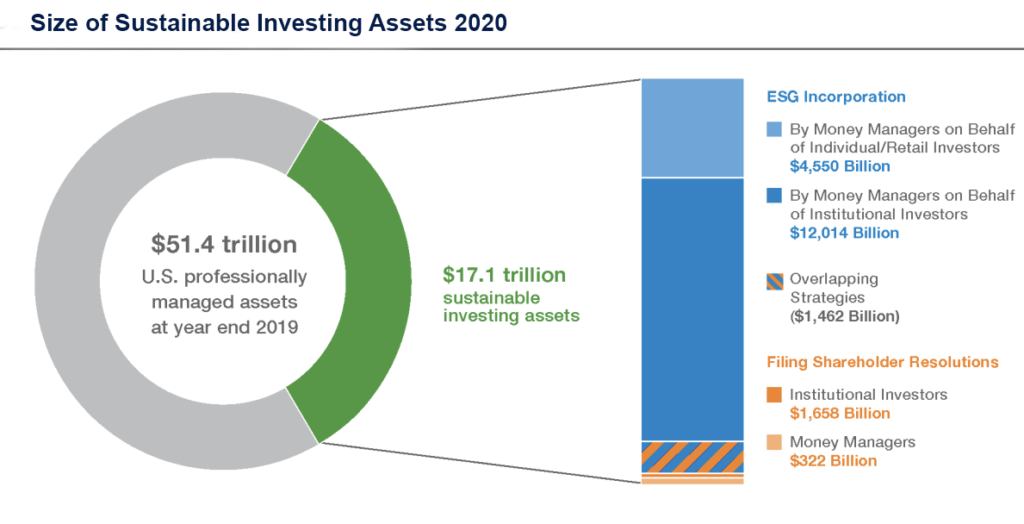

The Forum for Sustainable and Responsible Investment, or US SIF, recently released the 13th edition of its Report of US Sustainable and Impact Investing Trends, and the data confirm the continued increase in responsible investing. According to the report, 33%, or 1 in every 3 dollars, of assets under professional management now use some form of environmental, social and governance (ESG) criteria or strategies as part of portfolio analysis and selection. This is a 25-fold increase since this assessment began in 1995.

The business case for why investors should care about sustainable investing has never been more apparent. We now have ample evidence that sustainable strategies perform as well as or even better than traditional strategies. Click here to read examples for equities and click here for bonds.

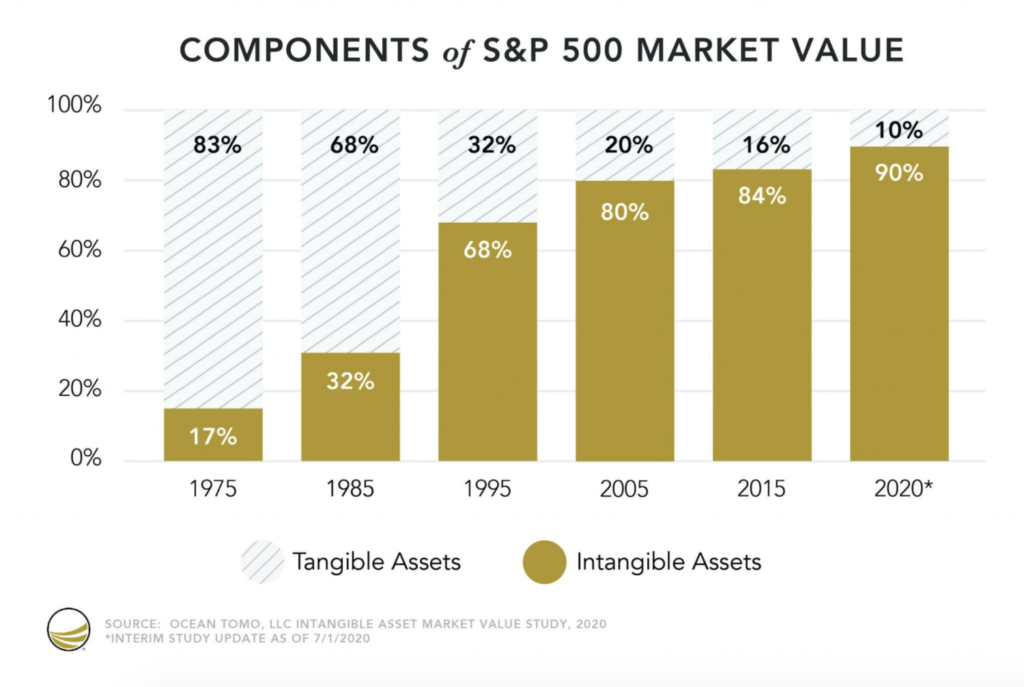

We also witnessed CEOs in the Business Roundtable issue this Statement on the Purpose of a Corporation, a landmark shift away from shareholder primacy and towards Stakeholder Capitalism. These corporate leaders didn’t just wake up and decide to become more compassionate global citizens than their predecessors. Rather, they have realized that their firms’ value is now more connected to external stakeholders than ever before.

In 1975, intangible assets made up 17% of the average firm’s value. Fast forward to 2020, where the value attributed to intangible assets went up to 90%. Older firms could measure their value in terms of property, plants and equipment. Today, most value is found in much more intangible measures, such as reputation, brand loyalty and good will.

Long before Stakeholder Capitalism was even a concept, our clients sought investment solutions that aligned with their faith values. We have over fifty years of working to ensure that profits and opportunity are not limited by the color of a person’s skin, nor by their gender or sexuality. Our clients have pressed us to ensure that our investments honor the God- given dignity of every person and support the ecological sanctity of the planet we share as a common home.

We have a name for this work: Investing with a Mission.