By Matthew Illian, Director of Responsible Investing

The Interfaith Center on Corporate Responsibility (ICCR) and many of its members, including United Church Funds, have long championed the alignment of compensation incentives with long-term, sustainable value, well before the Dodd-Frank law mandated Say on Pay votes. The largest asset managers in the world also state the importance of designing executive compensation packages with long-term sustainable growth in mind. But new research commissioned by ICCR reveals that support for executive compensation varies widely between asset managers. These differences carry significant implications for asset owners and asset managers given the concentration of voting power in a small number of U.S. firms and the growing scrutiny of executive compensation design.

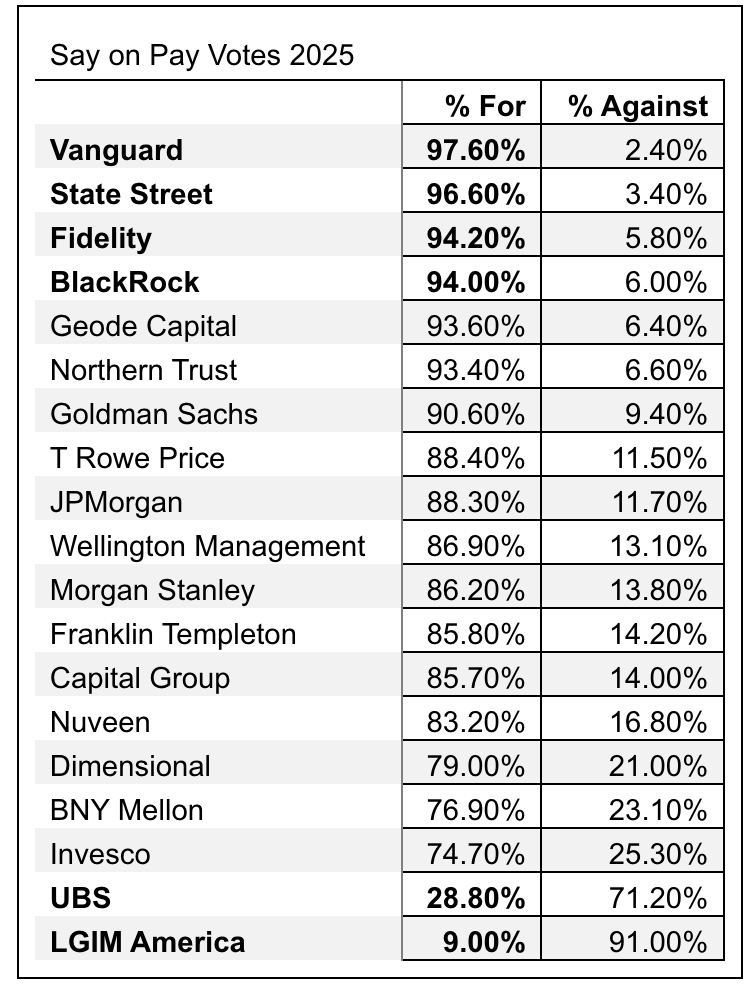

Large U.S. Managers Are Highly Deferential to Management on Say on Pay

2025 proxy voting research reveals that Vanguard, State Street, Fidelity and BlackRock are among the most likely to vote in favor of Say-on-Pay proposals, with Vanguard topping the list by voting in support more than any other asset manager in the report — 97.6% of the time. State Street came in second, with Fidelity and BlackRock following close behind.

The voting results of American asset managers studied contrast sharply with two European managers, Legal & General (LGIM) and UBS. LGIM America, the U.S. arm of London-based LGIM, reported $1.53 trillion in assets under management (AUM) and only voted in favor of executive compensation packages 9% of the time. UBS — based in Geneva, Switzerland, and reporting $6.6 trillion of AUM —only supported these packages 29% of the time.

A Note on Methodology

The data – provided by Canbury Insights – is drawn from asset manager NP-X filings for the July 1, 2024 to June 30, 2025, period that are submitted to the SEC annually by the end of August. Data shown is for all United States company holdings that had votes in that period (number of votes will vary based on the manager’s portfolio). The data aggregates voting across an asset manager’s mutual funds and ETFs. Note that Geode Capital is based on Fidelity’s index fund. Where there was split voting, it is counted as the majority share, i.e. 51 votes For and 49 votes Against is counted as For. Percentages may not sum due to rounding.

A Failure to Define Long-Term Performance

Both U.S. and European asset managers state their belief that executive compensation should promote long-term value creation. However, when it comes to defining long-term performance, Vanguard, State Street, Fidelity and BlackRock avoided specificity in describing how they define and measure long-term performance for incentive rewards. Without a yardstick, the definition of long-term performance is left to a case-by-case analysis. In contrast, UBS and LGIM provide more clarity. For example, UBS flags concern when Restricted Stock Units have a total vesting and holding period of less than five years, and LGIM states that long-term awards should be subject to a performance period of at least three years.

On April 25, Vanguard and BlackRock voted in support of Abbott Laboratories’ 2025 Say-on-Pay, while LGIM and UBS voted against it. UBS’s rationale for voting against Abbott’s executive compensation states: “Vesting performance awards or performance period is less than three years.” LGIM’s rationale states: “A vote against has been applied because the company has set only one performance metric to reward management for long-term performance. One metric does not by itself provide sufficient evidence of the overall long-term performance of the company.” In other words, both European asset managers believe Abbott’s executive compensation package is deficient because it focuses too much on the short term. Neither Vanguard nor BlackRock offered any guidance for why they voted in support of Abbott’s Say on Pay.

…continued:

Read the full article on Harvard Law School Forum on Corporate Governance.