This article provides greater detail for readers seeking additional information on our recent regulatory update.

Shareholder Resolutions

Every year, investors are offered the opportunity to elect a Board of Directors, appoint an auditor and vote on other corporate business, including resolutions brought up by fellow shareholders. The Securities and Exchange Commission (SEC) issued a policy recommendation (S7-23-19) that makes it more difficult for smaller investors to get their voices heard. Currently, investors only need to hold at least $2,000 of a security for one year to file a resolution. The proposal would require holding the same amount for three years or holding $25,000 for one year. This increase would not impact UCF as our holdings are typically far in excess of these new limits. But it would impact many individual investors, such as Jim McRitchie, who has volunteered brilliantly and tirelessly in support of investors everywhere over many years.

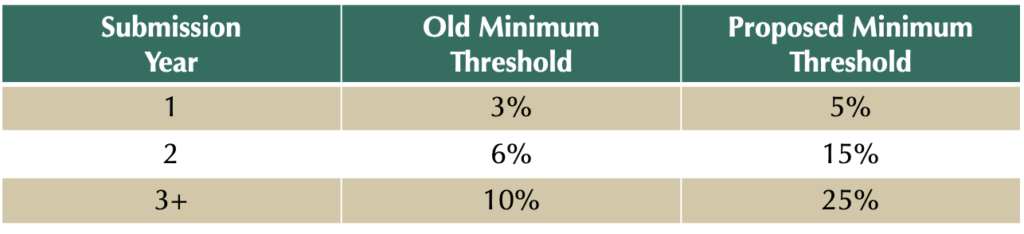

The SEC is also trying to make it harder for a resolution to be reintroduced in consecutive years. The changes to minimum voting thresholds are as follows:

This means that in order to be able to reintroduce a resolution for a fourth consecutive year, at least 25% of the vote would need to support the measure in the prior year (year 3).

This means that in order to be able to reintroduce a resolution for a fourth consecutive year, at least 25% of the vote would need to support the measure in the prior year (year 3).

Our partners at Interfaith Center on Corporate Responsibility (ICCR), Principles for Responsible Investment (PRI), and US Sustainable Investment Forum (USSIF), along with every other reputable shareholder advocacy group, have all come out against this regulation to raise the minimum threshold for resubmission. Removing shareholder resolutions from consideration by all eligible voters would be unfortunate. For example, ICCR highlights three case studies where these new rules would limit the attention paid to human rights. Research[i] performed by the Sustainable Investments Institute found that the new thresholds would triple the number of ineligible shareholder resolutions going into 2021. UCF’s recent shareholder resolution with AbbVie, calling for a separation of the board chair and CEO positions, received 23.9% of the vote, and a similar resolution at Gilead received 43.4%, both above the minimum necessary thresholds to resubmit in future years. But the SEC change may affect future resolutions that we file or support.

Sustainable & Responsible Investments (ESG) in Retirement Plans

The Department of Labor (DOL), which oversees all pension and retirement plans, recently proposed new legislation (RIN 1210-AB95) making investing in sustainable and responsible strategies more difficult. While this legislation does not impact UCF — we do not manage retirement plans — we stand with our partners in the field who see this action as a step in the wrong direction.

The biggest flaw in this recommended ruling is the prohibition of “ESG-themed funds” from default investment options. These default investment options are typically the target-date funds that many investors now rely on because they take care of the asset allocation and rebalancing decisions for plan participants. Banning even a small component of “ESG-themed funds” from the default investment options will greatly limit the usage of sustainable funds in retirement plans.

This legislation also makes it more difficult to put any funds managed with a responsible and sustainable mandate in any type of retirement or pension fund governed by ERISA. This entire recommendation should be turned on its head. Our friends at the PRI share that “In our view, all investment options should be required to integrate ESG factors as part of prudent investment decision-making.” You can read letters opposing this action from ICCR, USSIF and PRI.

Recently Passed Legislation Concerning Proxy Advisors

To help manage the shareholder voting responsibility, many asset managers (including UCF) hire proxy advisors like Glass Lewis and ISS to help with corporate governance research and submit tens of thousands of votes every year. On July 22, the SEC voted to introduce new requirements to proxy advisors, requiring them to disclose any conflicts of interest they have, which we view as a positive development. Additionally, the rules now require that proxy firms allow corporations to publish a response to their recommendations. While we disagree with this ruling that forces proxy advisors to solicit corporate feedback when publishing independent research, our partners at Glass Lewis share that their platform already allows for this feedback, and they do not see this rule having any impact on their service. Both changes go into effect for the 2022 proxy season.

[i] Welsh, Heidi. “Comparative Impact of Proposed Rule 14a-8: Social and Environmental Policy Shareholder Resolutions.” Sustainable Investments Institute, 28 July 2020.