Organization Management

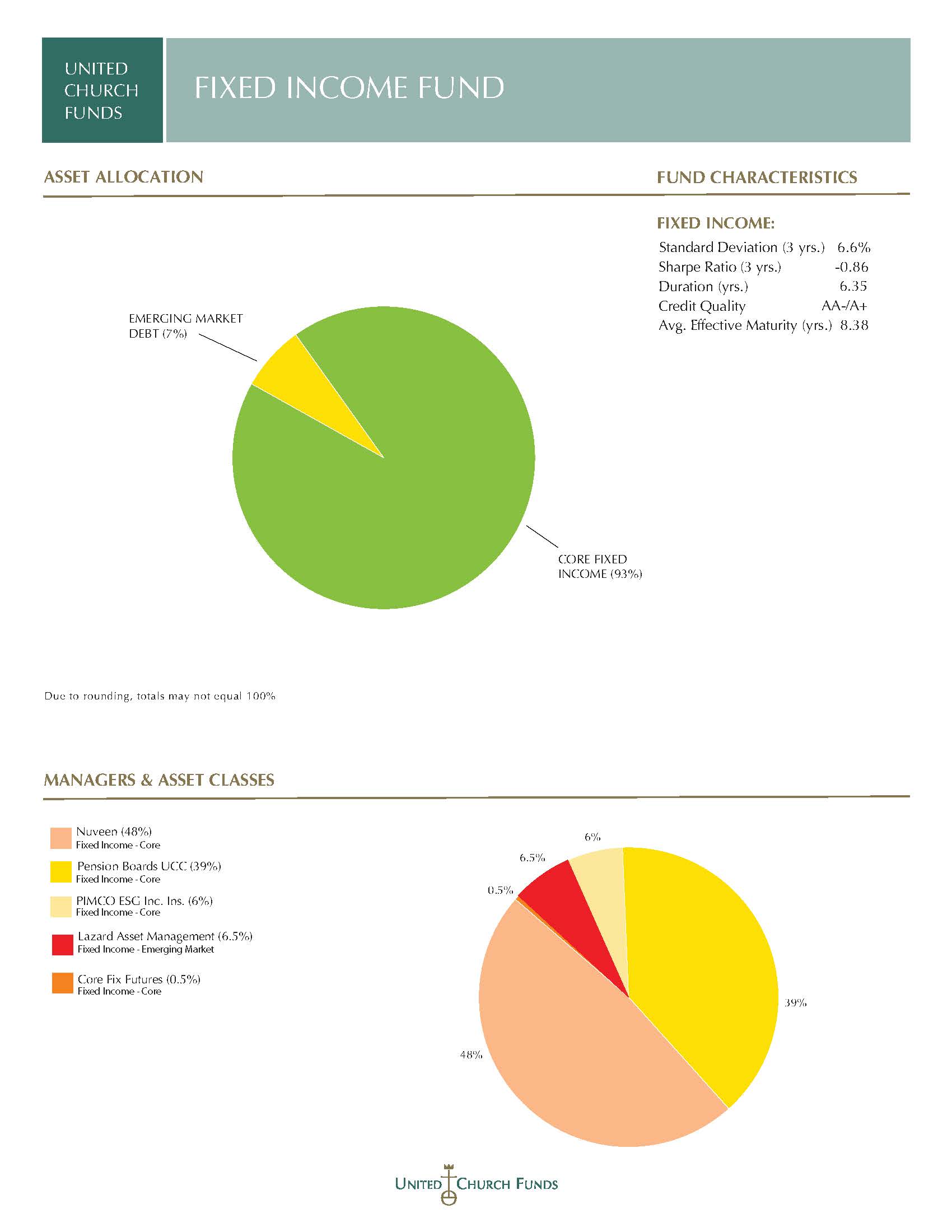

Nuveen Core Impact Bond

Nuveen seeks to provide a long-term total return through income by investing in investment-grade securities that meet the team’s ESG criteria, with a special consideration to social impact (Proactive Social Investments), which has been ~30-40% of the portfolio. Impact themes include affordable housing; community and economic development; renewable energy; and climate change and natural resources. Click here to learn more about Nuveen Core Impact Bond.

The Pension Boards-United Church of Christ, Inc.

The Pension Boards-United Church of Christ, Inc’s (PBUCC) Fixed Income team manages the Core Fixed Income portfolio, a diversified portfolio comprised of US government and corporate bonds. The team comprises long-term investors who seek to capitalize on opportunities that arise when valuations move toward extremes. It believes that over longer periods, the majority of returns in the bond market will be derived from yield and not capital appreciation. Since the 2008 financial crisis, tactical adjustments have been driven more often by macro factors such as changes in the economic, political, and regulatory environment. Based at the combined PBUCC/UCF headquarters in NYC, the Fixed Income team manages over $1 billion, and has invested on behalf of the UCF since 1987.

Lazard Asset Management

Lazard Asset Management manages the emerging market debt (EMD) blend strategy with both a global thematic approach and a bottom-up credit research focus that stresses total return, a benchmark agnostic approach, and active asset allocation to EMD asset classes. The emerging market debt blend strategy includes both dollar denominated as well as local currency sectors. The portfolio is broadly diversified across currencies, countries and sectors. Founded in 1970, Lazard is located in New York City and manages $183 billion across many strategies.

Community Capital Management

Founded in 1998, Community Capital Management (CCM) is an SEC-registered investment advisor that specializes in managing impact investing and fossil fuel free portfolios. Its intermediate fixed income strategy, launched in 1999, focuses on making qualified investments under the Community Reinvestment Act. Over the last 16 years, it has delivered steady risk-adjusted returns while providing added diversification and positive impact on the community.